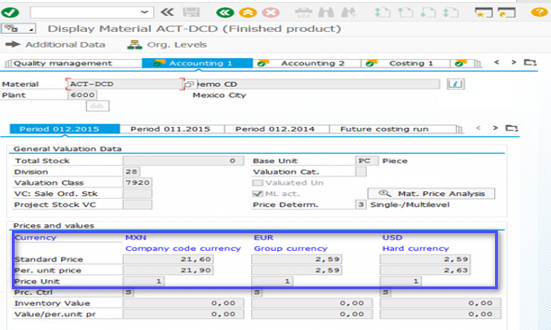

Product Costing is the tool used in SAP for planning costs and establishing material prices. It helps in estimating the Cost of goods sold for each product unit. Product Cost planning involves planning the costs for materials without reference to orders and set prices for materials and other cost accounting objects. It consists of creation of material cost estimates and transferring the results of material cost estimates to the material master.

Inventory Valuation is also a part of Product Costing and allows to valuate stocks of a material either together or separately, that is, according to different valuation criteria. Should this be expanded to include Inventory valuation.

Product Costing does not run in the Central Finance System. All the Product Costing relevant scenarios are maintained in the Source System and then replicated to cFIN System. Only exceptional objects could be maintained centrally in cFIN System and distributed to the Source, for example: Activity Rates planning. Data replicated from the source to the target system helps to enable comprehensive analysis of the financial data to attain Managerial Accounting requirements.

Material cost estimates function enables you to cost out your finished and semi finished materials and update the material master data with the calculated costs. Customers with distributed source systems require centralized cost estimate information to get a consolidated value chain across different company codes / plants.

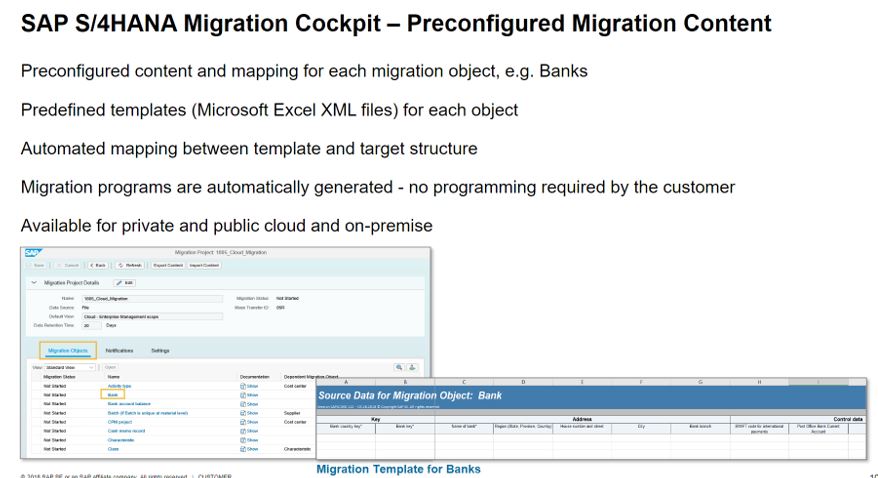

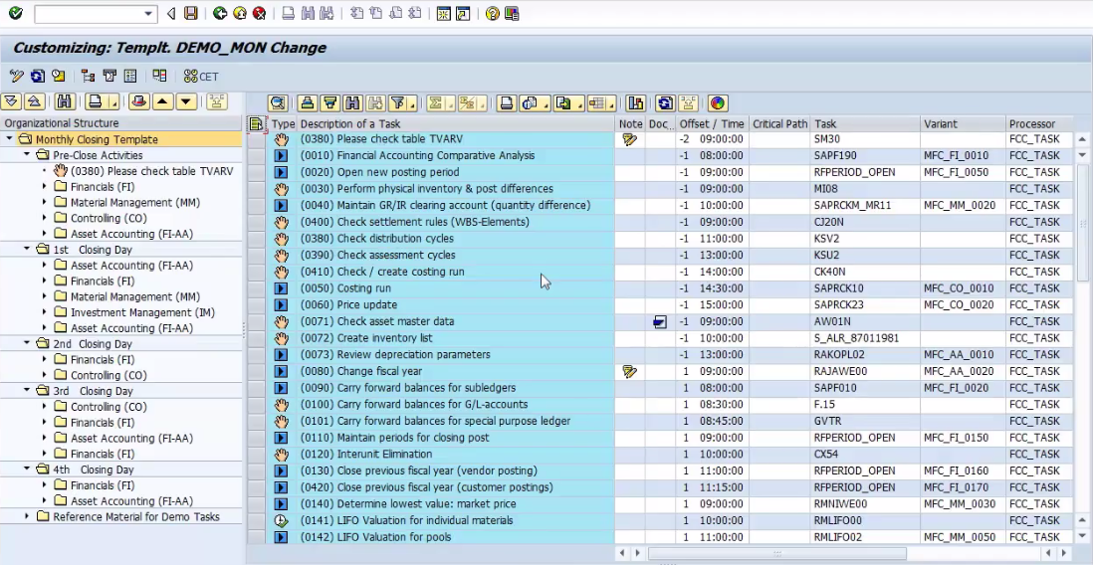

Initial Load of Material Cost Estimates

You can perform an initial load of material cost estimates to transfer material cost estimates from a source system to the Central Finance system, such as loading material cost estimates from periods prior to the start date of ongoing replication.

The initial load of material cost estimates is carried out using the SAP Landscape Transformation Replication Server (SLT).

The initial load has the same restriction and uses the same AIF interface as material cost estimate ongoing replication.

The material cost estimates to be transferred are validated against the transfer rules.

Note: Please specify the data scope of initial load via transaction LTRS in the SLT system before carrying out the initial load. If not, all the relevant material cost estimates in the source system will be transferred in the initial load process.

Define the initial load object in SLT using the predefined initial load object CFI_KEKO_L.

After the initial load of material cost estimates has been started in SLT, the data is transferred from the source system to the Central Finance system and validated against the transfer rules. The final processing result is shown in SAP Application Interface Framework (AIF), under namespace /FINCF, interface CE_MAT.

| Posting Type | Table | Replication Object | Load Object |

| Cost Estimate | KEKO | CFI_KEKO_R | CFI_KEKO_L |

Goto SE38, start program IUUC_REPL_PREDEF_OBJECTS.

Add above mentioned Initial load object (CFI_KEKO_L) and replication object (CFI_KEKO_R) by clicking on “Copy predefined object” in below mentioned screen.

Ongoing Replication of Material Cost Estimates

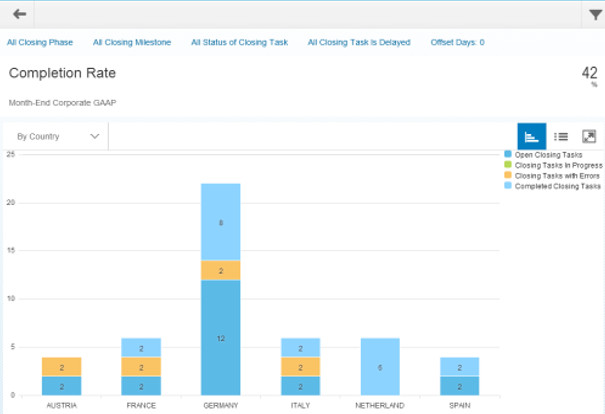

Product costing in CFIN refers to replicating the cost estimate from source systems to one centralized system in real time. Product costing with CFIN helps display cost estimates with group evaluation and the cost of the whole value chain can be analyzed in one centralized system.

Ongoing replication of Material cost estimates helps you to continuously replicate material cost estimates from source systems to the Central Finance system. For a mixed costing, the material cost estimates are replicated together with the relevant procurement alternatives.

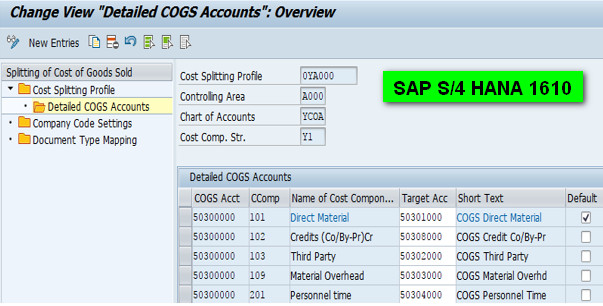

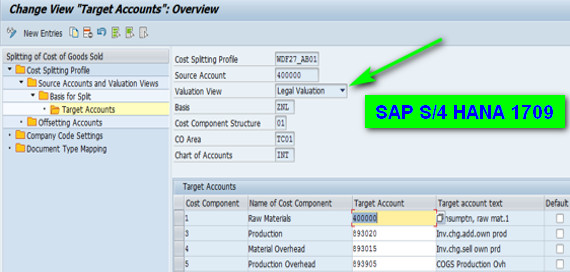

Configuration in SAP S4 Central Finance system:

DEFINE RULE FOR COST ESTIMATE REPLICATION

You can define rules for replicating cost estimates from a source system to the Central Finance system. During ongoing replication all cost estimates from a source system will be validated against the rules you define here.

- Only correctly validated cost estimates are transferred from the source system to the Central Finance system.

- If no rules for cost estimates are defined here, then no cost estimates are transferred to the Central Finance system.

In the header section, you specify the following for replicating cost estimates:

- Logical System: Enter the logical system of the source system from which the cost estimates are transferred.

- Reference Object: Select the type of cost estimate that is transferred, for example 0 for Material Cost Estimate.

- Controlling Area: Enter the controlling area for the cost estimates that are transferred.

- Plant: Enter the plant for the cost estimates that are transferred.

- Costing Variant: Enter the costing variant for the cost estimates that are transferred.

- Costing Date From (Optional): Enter the date from which execution of cost estimates are allowed for transfer.

For each header rule, you need to maintain item rules in the item section, in which you specify the following:

- Variant: Select the variant, for example Costing Status or Costing Version

- Variant Value: Enter a value depending on which Variant you have selected. If you have chosen Costing Status for the Variant field, only a specific costing status is acceptable. If you have chosen Costing Version for the Variant field, either a specific costing version or *(representing all costing versions) is acceptable.

Note:

- Currency settings for a controlling area need to be consistent between source and Central Finance systems.

- Currency settings for a company code need to be consistent between source and Central Finance systems.

- You have configured the mapping entities for the source data in MDG, mainly including:

- Material Number

- Plant

- Controlling Area

- Cost Center

- Cost Element

- Activity Type

- Cost Component Structure

- Cost Component Number

- Costing Variant

Product Costing Tables for replication:

- The tables for material cost estimates are KEKO, KEPH, CKHS,CKIS, CKIT.

- The tables for procurement alternatives are CKMLMV001, CKMLMV001T, CKMLMV002.

- KEKO (Product Costing Header Data) is the trigger table for SLT extraction, i.e. when there is a change in KEKO, the business data from KEKO and other tables will be extracted and transferred.

- The table KEKO in the Central Finance system has been enhanced to store the sender’s key fields such as cost estimate number, costing date, etc.

Replicate Material Cost Estimates Manually

You use this function to manually transfer some historical or dedicated material cost estimates. Or you use this function when following errors happen in the ongoing replication.

- There are errors in AIF during ongoing replication, but you can’t restart these messages properly due to some special reasons.

Run transaction FINS_CFIN_MCE_REPL

The below architecture diagram represents the different interfaces which are available for replication from Source system to Central Finance.

Conclusion:

In summery, apply required oss notes for the replication of material cost estimate to target system and apply prerequisites, manual activities mentioned in oss notes such as 2800883 and 2969005. There are functional restrictions that needs to be considered incase of cost estimate initial load and replication. Please read following web link for more information on Material cost estimate replication.

Thank you

Jay