As per the law issued by Govt of India, tax applicability will be as follows in GST regime,

- Intra – State transactions will attract CGST and SGST

- Inter – State/Import transactions will attract IGST

- Export transactions will be zero rated

Following condition types required,

JICG, JISG and JIIG are the deductible GST condition types for Central, State and Integrated GST. Whenever user creates an invoice using these condition types using tax code, the system will posts the accounting entry into defined GL accounts…!!

| Condition types | Description |

| JICG | AP: Central GST |

| JISG | AP: State GST |

| JIIG | AP: Integrated GST |

The setup of the GL accounts will be done for each account key

Below mentioned are the account keys to be created in SAP for deductible condition types.

- JIC – Central GST

- JIS – State GST

- JII – Integrated GST

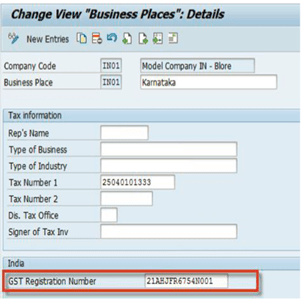

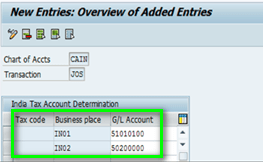

Productive GST GL accounts should be maintained in table J_1IT030K_V

Business Place Linkage to GST GL accounts is also to be assigned in table J_1IT030K_V

JISN, JICN and JIIN are the non-deductible GST condition types for state, central and integrated GST. Whenever user creates an invoice using these condition types using tax code, the system will posts to Inventory/Expense accounts based on the standard SAP Process.

| Condition types | Description |

| JISN | AP: Central GST – ND |

| JICN | AP: State GST – ND |

| JIIN | AP: Integrated GST – ND |

Account key “NVV” will be used for Non-deductible GST condition types

Similarly GST relevant condition types and account keys for SD procedure are as below,

JOCG, JOSG and JOIG are the deductible GST condition types for Central, State and Integrated GST. Whenever user creates an invoice using these condition types using tax code, the system will posts the accounting entry into defined GL accounts…!!

| Condition types | Description |

| JOCG | AR: Central GST |

| JOSG | AR: State GST |

| JOIG | AR: Integrated GST |

Below mentioned are the account keys to be created in SAP for deductible condition types.

- JOC – Central GST

- JOS – State GST

- JOI – Integrated GST

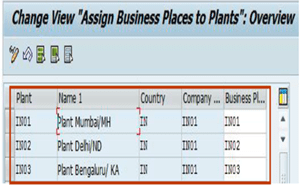

As part of Cutover below mentioned master data’s has to be modified with new GST fields,

Master data – HSN/SAC Code, Material master, Customer Master, Vendor Masters, Tax codes, Condition records and service masters.

For more GST related details refer my Vlog

Thank You

Jayanth